News

20 govs borrow fresh N446bn as revenues tumble

A recent report indicate that debt servicing costs incurred by 29 state governments consumed 80.7 percent of their Internally Generated Revenue during the first half of 2024, illustrating the significant financial strain these sub-national entities are currently experiencing.

This challenging situation compelled the governors to borrow a total of N446.29 billion within the same timeframe, despite a 40 percent increase in their statutory allocations from the Federation Account.

This data was obtained through an analysis of budget implementation reports available on state websites and Open Nigerian States, a repository supported by BudgIT.

The quarterly performance reports, issued within four weeks following the end of each quarter, reveal a critical issue in fiscal management.

The majority of state revenues, which could otherwise be directed towards essential public services and developmental projects, are instead being diverted to meet debt obligations.

Furthermore, the situation highlights the severe constraints faced by state governments in managing inherited debt burdens while attempting to address the pressing needs of their constituents.

With an increased statutory allocation of 40 percent from the central government, there were hopes that governors would be able to fulfill their statutory responsibilities more effectively.

In 2023, state governors received the highest Federal Accounts Allocation Committee (FAAC) allocations in seven years, a result of reforms following the removal of the petrol subsidy and currency adjustments.

Experts anticipated that this revenue increase would alleviate the states’ reliance on further borrowing; however, many are instead dedicating a substantial portion of their income to debt repayments while accruing additional loans.

Reports indicate that states such as Osun, Ondo, Kaduna, and Cross River will predominantly use their FAAC funds for debt servicing this year, with deficits of N10.94 billion, N27.72 billion, N15.83 billion, and N10.02 billion, respectively, resulting from debt servicing deductions.

As a large share of revenue is consumed by debt obligations, the ability of state governments to foster long-term economic stability and enhance the quality of life for their residents becomes increasingly compromised.

Earlier this year, Kaduna State Governor Uba Sani expressed frustration over the substantial debt burden inherited from previous administrations, which has hindered timely salary payments and increased borrowing during his administration’s first nine months.

Governor Sani reported an inherited debt totaling $587 million, N85 billion, and 115 contractual liabilities, stating, “Despite the significant debt burden, we remain committed to steering Kaduna State toward progress and sustainable development”.

“We have conducted a thorough assessment of our situation and are sharpening our focus accordingly.”

Earlier report claims that state governors are grappling with the challenge of stimulating their economies after inheriting approximately N2.1 trillion in domestic debts and $1.9 billion in external debts from their predecessors.

In the nine months following their assumption of office (July 2023 to March 2024), 22 states spent a combined N251.79 billion servicing debts incurred by prior administrations.

The situation also led the state governments of Ekiti, Cross River, and Ogun to propose a suspension of their $501 million foreign debt repayments, citing severe foreign exchange volatility.

Although FAAC rejected this request, it underscores the efforts of these states to mitigate the escalating debt service burdens, which officials claim have significantly impaired their ability to service existing debts.

Experts assert that high debt servicing costs severely limit investment in crucial areas such as infrastructure, education, and healthcare, which are essential for economic growth and social welfare.

In an another development, the Organized Private Sector has stated that Nigeria’s straight monthly decline in inflation rates contradicts the country’s existing economic realities.

On Monday, the National Bureau of Statistics (NBS) announced in its Consumer Price Index report that “In August 2024, the headline inflation rate further eased to 32.15 percent relative to the July 2024 headline inflation rate of 33.40 percent.” The report added,

-

Metro2 years ago

Metro2 years agoWhy We’re Crippling Activities In Abraka Tomorrow, Says Group

-

Education2 years ago

Education2 years agoJUST IN: EFCC Raids Abraka, Arrests 52 Internet Fraud Suspects

-

Education2 years ago

Education2 years ago‘Your love Strengthens Me’, Egwunyenga Celebrates Wife At 60

-

Education2 years ago

Education2 years agoDELSU Releases Cut-Off Marks For 2023/2024 Admissions

-

Education2 years ago

Education2 years agoInsurance Coy Indemnifies Families of Late DELSU Students

-

Lifestyle2 years ago

Lifestyle2 years agoOPINION: Why Tinubu Should Not Interfere In Niger’s Internal Affairs

-

Education1 year ago

Education1 year agoWhy DELSU Instituted Post-Matric Cleaning Exercise For Freshmen- Iwegbue

-

Education2 years ago

Education2 years agoIwegbue Goes Tough On Illegal Occupation Of DELSU Students’ Property

-

Education2 years ago

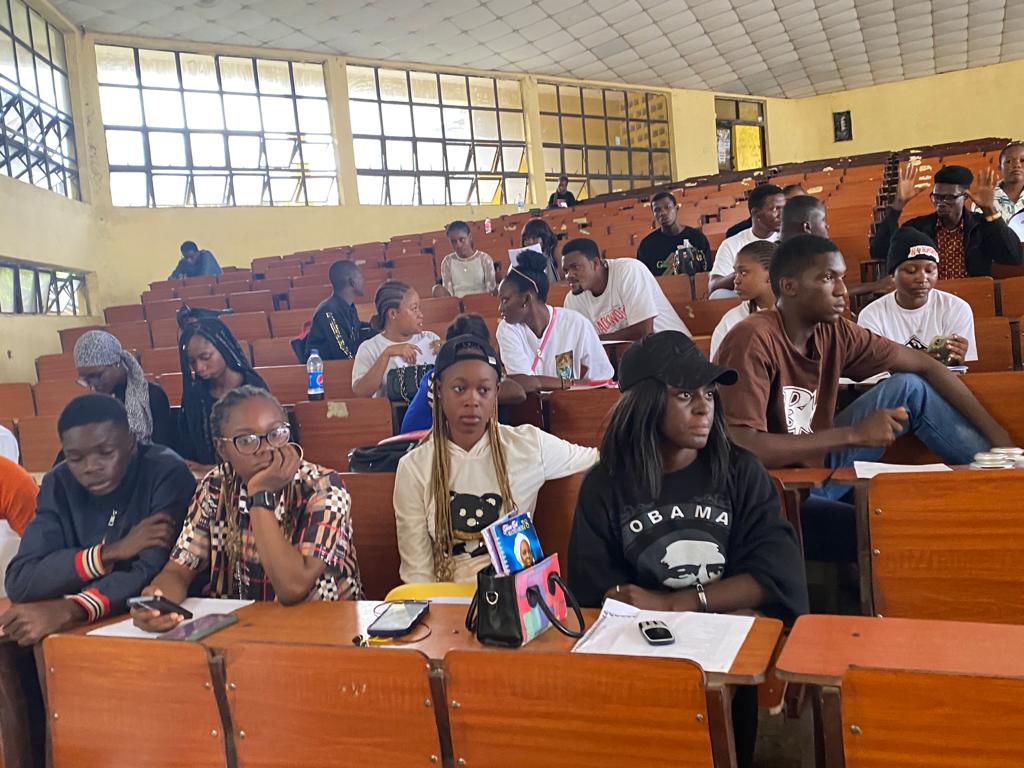

Education2 years agoDELSU DECIDES: Students Bemoan Disenfranchisement As Vote Collation Begins

-

Politics1 year ago

Politics1 year agoWe Are The Government We Call Out

-

Education2 years ago

Education2 years agoBREAKING: DELSU Releases First Batch Of 2023/2024 Admission List

-

Entertainment1 year ago

Entertainment1 year agoNotable Nigerian Celebrities Who Died in 2023

-

News2 years ago

News2 years agoNECA Urges NLC To Rethink proposed protest

-

Lifestyle1 year ago

Lifestyle1 year agoAVC Boss, Ofuegbe Advises Youths Against Cultism

-

DELSU ECHO TV2 years ago

DELSU ECHO TV2 years agoAlleged Scandal Rocks DELSU Mgt Science Students’ Election

-

Features1 year ago

Features1 year agoReflecting On The Biting Cost Of Living In Abraka

-

Education2 years ago

Education2 years agoFear Grips Students As Snakes, Rats Invade DELSU Hostels

-

Education2 years ago

Education2 years agoDELSU DECIDES: Matthias Emerges SUG President-Elect, Adoh, Osho Others Win BIG

-

Education1 year ago

Education1 year agoDELSU Extends School Fees Payment, Course Reg To Feb 5

-

Entertainment2 years ago

Entertainment2 years agoMohbad: Justice or Injustice?

-

Education1 year ago

Education1 year agoFor The Love Of Arsenal: DELSU VC Mulls Extension Of School Fees Deadline

-

Education2 years ago

Education2 years agoSad End! Three Dead, Many Injured As Graduating Students Indulge In Wild Celebration

-

Education2 years ago

Education2 years agoDELSU Gets 100% NUC Accreditation

-

Entertainment2 years ago

Entertainment2 years agoK-Dramas To Premiere On AIT In Sept

-

Education2 years ago

Education2 years agoEgwunyenga Gets Highest SUG Honour, Pledges Greater Support For Unionism

-

News2 years ago

News2 years agoElection: CDD Urges Politicians, Media To Shun Divisive Utterances

-

Education2 years ago

Education2 years agoEgwunyenga Urges Varsity Staff To Embrace ICT, Gets SSANU Award

-

Education2 years ago

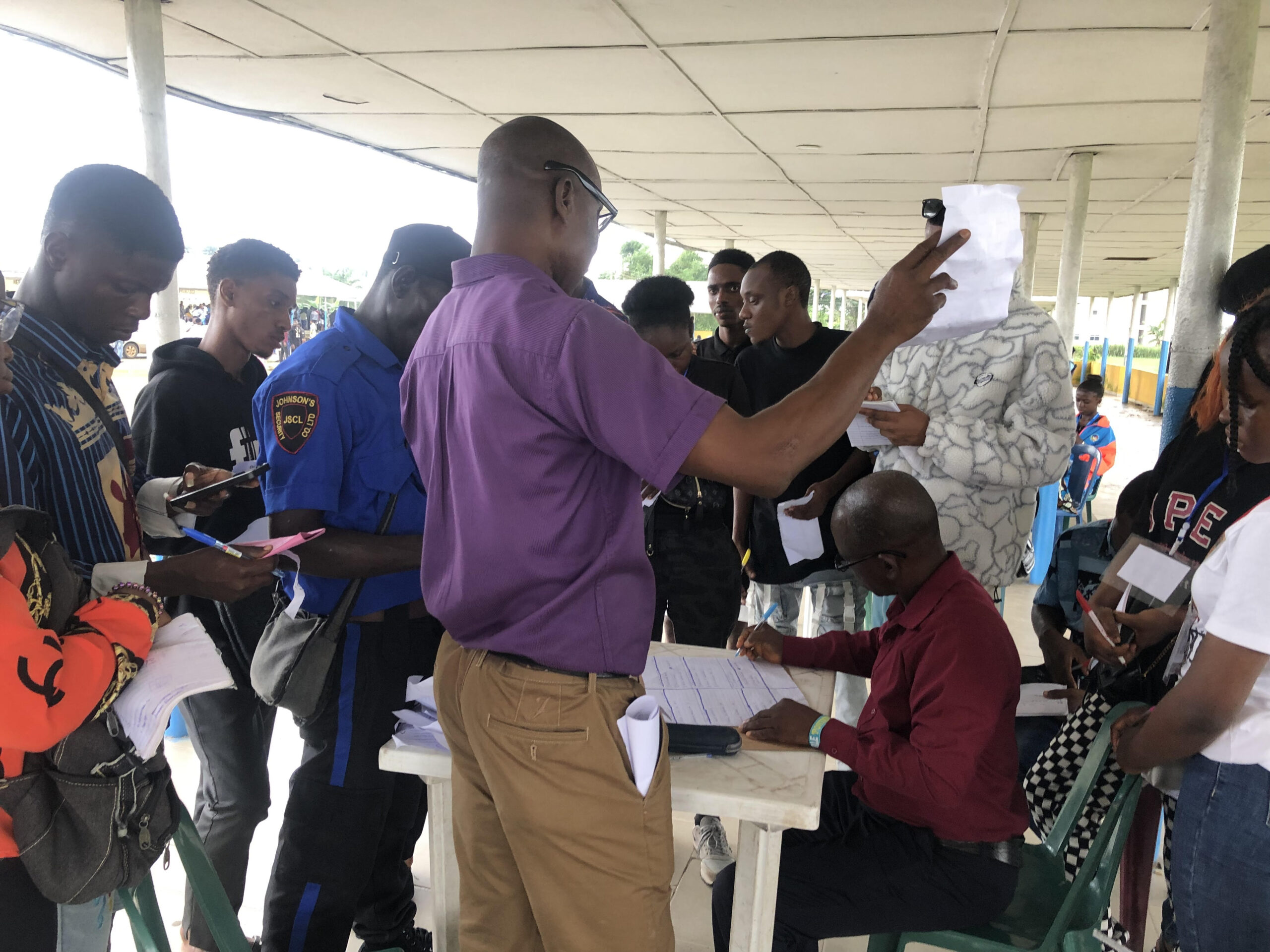

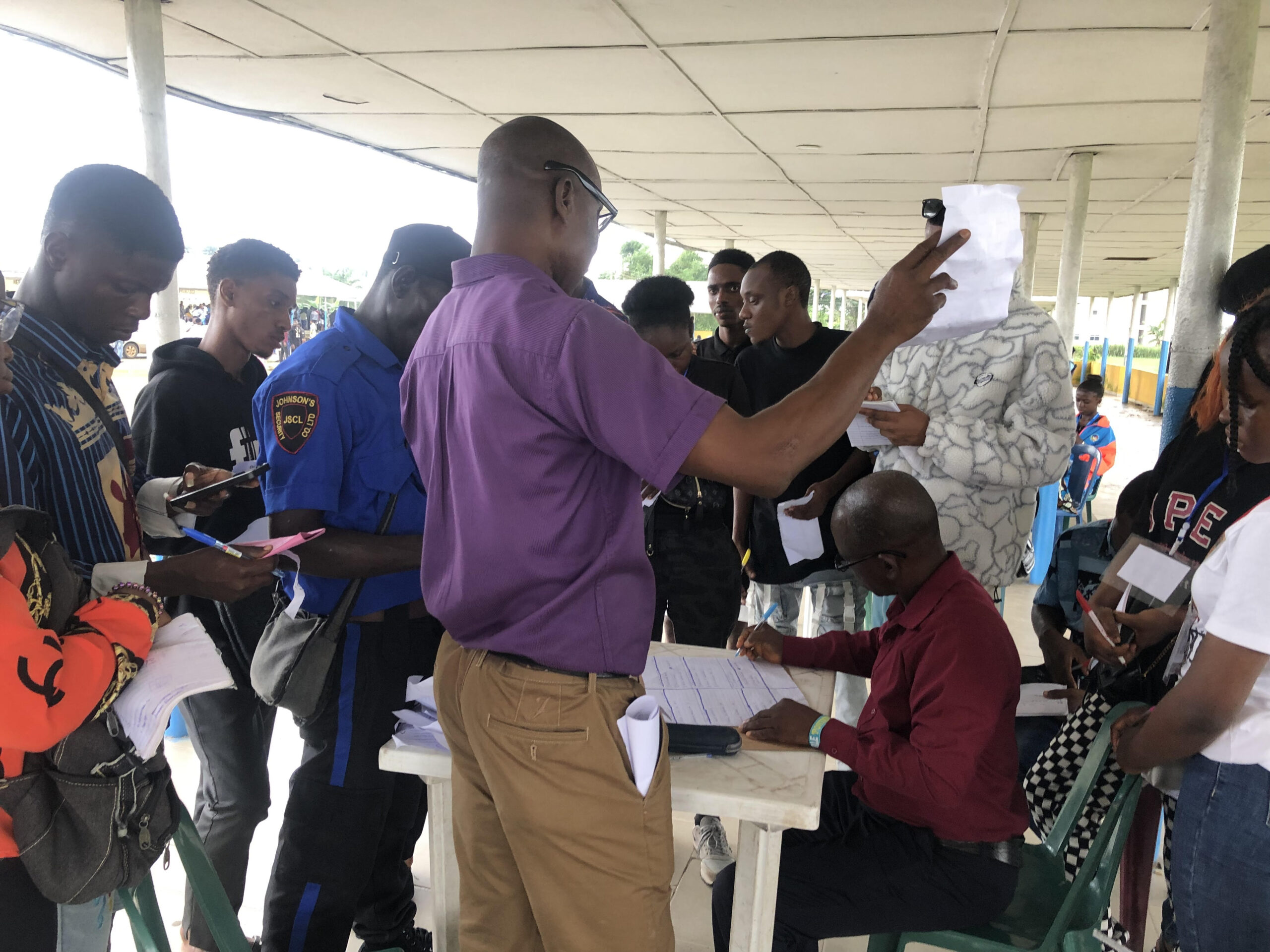

Education2 years agoCandidates, Parents Speak On DELSU 2023 Post-UTME Screening

-

Education1 year ago

Education1 year agoSuicide, Hard Drugs Not Solution To Stress, DELSU VC Tells Freshmen

-

Education1 year ago

Education1 year agoDELSU Now In Enviable Position Among Varsities, Says V-C

-

Education2 years ago

Education2 years agoResidents, Motorists Decry Worsening Condition Of Abraka Roads

-

Metro2 years ago

Metro2 years agoMob Brutalises Abraka Teenager Who Allegedly Steals Female Pants For Money Rituals

-

Education2 years ago

Education2 years agoHomecoming: Alumni Of Defunct College Of Education, Abraka Reunite, Pledge Improved Ties With DELSU

-

Education2 years ago

Education2 years agoINTERVIEW: I’ll Tackle Indiscipline, Environmental Challenges In FSS – Prof. Ogege

-

Education2 years ago

Education2 years agoBREAKING: DELSU Commences Sales Of 2023/2024 Postgraduate Forms

-

Education2 years ago

Education2 years agoDELSU Ready To Float Dentistry Faculty, Egwunyenga Tells NUC

-

Features1 year ago

Features1 year agoOPINION: A New Year’s Present

-

Education1 year ago

Education1 year agoDELSU VC Restates Commitment To Timely Graduation Of Students As PCN Inducts 76 Pharmacists

-

Education1 year ago

Education1 year agoMDCN Inducts 40 Doctors At DELSU, Begs Them Not To ‘Japa’

-

Education2 years ago

Education2 years agoEditorial: The Proposed DELSU Waste Management Scheme